Tuesday 23rd Aug, 2022

If someone is lending you money they must be registered with the Financial Conduct Authority (FCA).

The FCA regulates consumer credit providers in the UK to ensure they operate fairly and in accordance with the law.

A loan shark is an unregistered moneylender. These illegal lenders target families on low incomes or those facing difficult times. They often start by posing as a family friend before trapping vulnerable people in a spiral of debt and resorting to the most extreme methods to claim back their illegal loans.

How can you tell if a lender is operating legally?

You can search the Financial Services Register to see if a lender is authorised to lend money.

Warning signs that you, or someone you know, could be dealing with a loan shark include:

It’s important to understand that you are not breaking the law by taking a loan from an unlicensed lender, but are likely to be ripped off or worse. They are the ones breaking the law. You may not have to pay the loan back.

What can be done about loan sharks?

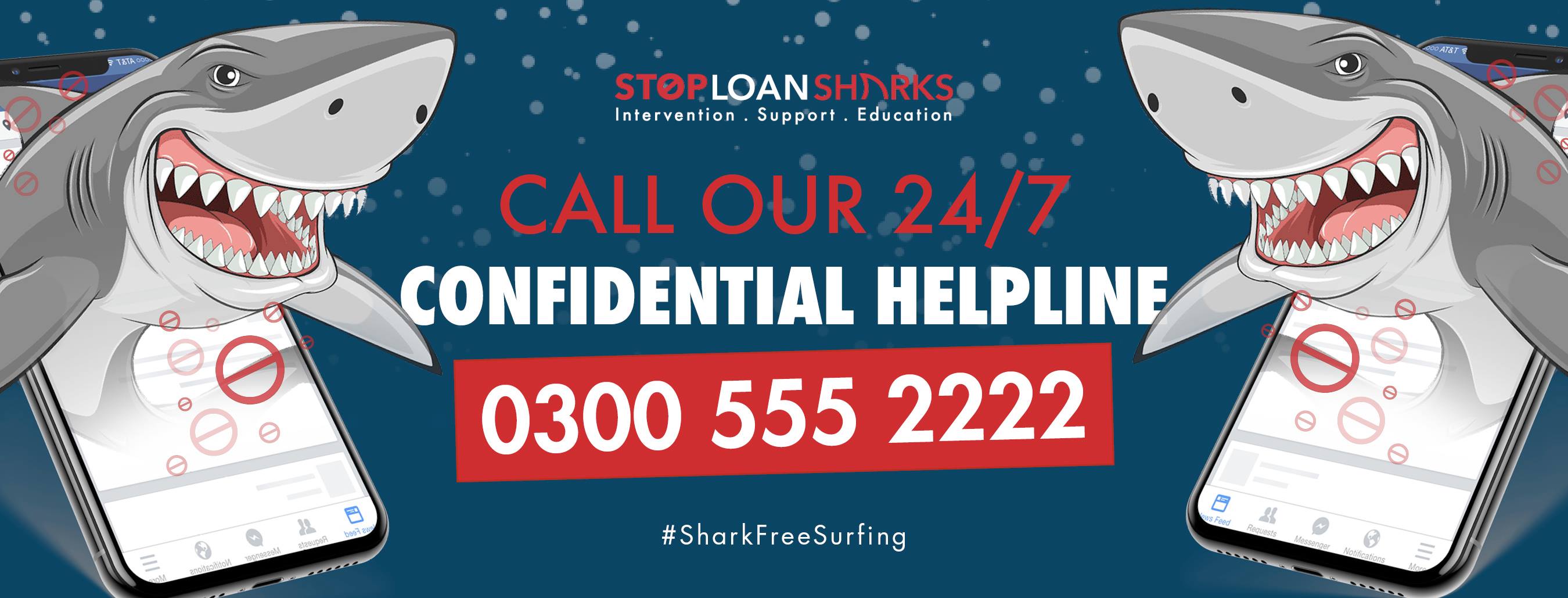

Stop Loan Sharks (officially known as the England Illegal Money Lending Team) is an organisation with the power to investigate and prosecute loan sharks. Since 2004 they have helped over 30,000 people who have borrowed from loan sharks.

You can report illegal lenders to them anonymously and in complete confidence in the following ways:

The trained team will contact you back at a time to suit you, give you any practical and emotional support needed, and take appropriate action against the loan shark. You will not be in trouble with the authorities and the loan shark will not know who has reported them. The whole community benefits when a loan shark is brought to justice.

This article is for general information only and does not constitute financial, legal, or any other form of advice.

JES